Deepak Chopra may be guru to Hollywood stars but he's sure not to have these two women on his speed dial. For a man raking in the bucks, selling old wine in stylish, new bottles, he's got some antediluvian ideas. He believes women in the corporate world lose their feminine shakti!

Deepak Chopra may be guru to Hollywood stars but he's sure not to have these two women on his speed dial. For a man raking in the bucks, selling old wine in stylish, new bottles, he's got some antediluvian ideas. He believes women in the corporate world lose their feminine shakti!He certainly should line up to meet Swati Piramal and Kiran Mazumdar-Shaw. Both of whom are in cutting edge careers. Director of Nicholas Piramal, Swati A Piramal and Chairman & Managing Director, Bicon, Kiran Mazumdar Shaw are the women, who are in the forefront of the biotechnology movement in India. The West may be miles ahead of us, when it comes to biotech research but these two women have atleast given us a good start.

Mazumdar explains, "I think what has happened is, biotech has been a sort of an untrodden path and it hasn't been a crowded space. In fact, it has been a fairly unexplored space, so I think the focus on the opportunities, were more in the pharma sector and less in the biotech sector and in terms of scientific challenge, there are plenty of women in this country.

Though, women have never had it easy, even in the West, there is a belief that scientific careers are not meant for them. This kind of statement created quite a ruckus recently, when the Harvard dean and Former Treasury Secretary, Lawrence Summers made it. Mazumdar told CNBC-TV18, "Well I think that was quite a controversy and I don't think there were too many people, who would agree with his view, we don't agree."

Piramal explains, "Women in science, they are really coming up and Larry Summers talked about some of the hurdles and I think we have those, but the point is, how do we get across those hurdles. I am on the Prime Minister's advisory board, and we're writing a paper called Women in Science, on how do we get more women in India to study science."

Piramal explains, "Women in science, they are really coming up and Larry Summers talked about some of the hurdles and I think we have those, but the point is, how do we get across those hurdles. I am on the Prime Minister's advisory board, and we're writing a paper called Women in Science, on how do we get more women in India to study science."Indian women could be cajoled into studying sciences, Swati Piramal explains, "There are 3-4 things that really make them scientists. One of them is a parent who really believes that a child can learn science, whether it's a boy or a girl. The second is that, someone has told her that you can achieve, you can do this. The third is, somebody has taught you this love for science - a teacher, a professor, a book, it could be anything. So these are the three factors which I think really influences a woman, and of course, the last is a role model."

Ofcourse, these two women are exactly the kind of role models for a future generation of female scientists. They have started the race and the baton will surely be passed on. In fact, they are already making a difference in boardrooms.

Piramal elaborates, "I actually found myself, though I am scientist, on three finance and insurance companies and I asked them why did you ask me on the board, they said we want people who can think of things in a different way and not their own standard. And I think, women bring that sort of diversity, the differentiation and creativity, this is kind of natural for them."

Mazumdar agrees and says, "There is a little sensitivity attached to whatever you are doing. When it comes to human relations, I think their sensitivities are far more acute amongst women, than it is among men."

"Very often in my company, many of my male colleagues when they are faced with the human relation dilemma, they come to me and say, hey do you think, I should dissolve this problem. You can ask them why they come to me, they say, somehow, you give us a very different way of thinking about these issues and maybe that's the way it's going to be solved."

Both of them are representing a new science and they have been the faces of India abroad in their field. Mazumdar acknowleges this, "Yes, I have sort of been a brand ambassador for Indian biotech for many years and yes there has been a credibility issue because India has never been really an R&D hot bet and I think that is something that I wanted to kind of change - that we are not just imitators, but we are innovators."

"But today, I think when I stand there, people sit and listen to me and take me seriously and I think that's the transformation I am seeing." Piramal admits that people do seem to take them seriously now. Especially with India's potential to deliver affordable drugs for five billion people.

Mazumdar explains, "Obviously, when you are in a business like ours and when you are driven by an ambition to basically deliver a billion dollar drug, out of your research table, I think that is really a very exciting space to be in. I think, to me affordable drugs for a large part of the world is something that is very possible, only out of India. And I think, if we can really develop an important drug in an affordable way out of India, that would mean a lot to me."

Mazumdar explains, "Obviously, when you are in a business like ours and when you are driven by an ambition to basically deliver a billion dollar drug, out of your research table, I think that is really a very exciting space to be in. I think, to me affordable drugs for a large part of the world is something that is very possible, only out of India. And I think, if we can really develop an important drug in an affordable way out of India, that would mean a lot to me." The flipside to being so incredibly focused is that one could lose out on the lighter moments in life. Kiram Mazumdar says that after Biocon went public, she's become a bit boring! The pressures of running a company with shareholders to answer to have not left much time to pursue her interests much.

So, she considers it a bonanza, when she can catch a rock or a western classical concert, in India or abroad. She also tries to watch a game of tennis, when the Wimbledon's on but even though she like golf, she hasn't been able to tee off for two years now! Well, you win some and you lose some.

Both have also authored and co-authored books, appreciate art and both are a 'husband-wife team', as Mazumdar puts it. She says, "There is another dimension which I never thought about, even though I knew about it, and that is, we both are a husband and a wife team. The most important role that someone can play in building these careers for women, are husbands."

Swati Piramal has co-authored two books with Mrs Tarla Dalal titled 'Eat Your Way to Good Health,' and another 'Diet and Nutrition Guide for Patients with Renal Disease and Renal Disorders'. While Kiran Mazumdar's coffee table 'Ale & Arty: The Story of Beer' is for the lager fans.

Swati Piramal has co-authored two books with Mrs Tarla Dalal titled 'Eat Your Way to Good Health,' and another 'Diet and Nutrition Guide for Patients with Renal Disease and Renal Disorders'. While Kiran Mazumdar's coffee table 'Ale & Arty: The Story of Beer' is for the lager fans.The multifaceted Piramal has also directed a music video called 'The Science Anthem with some of India's greatest musicians, lyricists, dancers and filmmakers and written an Indian opera called 'The Dance of Life', which tells the story of 2,500 years of Indian scientific discoveries, including astronomy, mathematics, ayurvedic medicine and other life sciences

That beauty is a part of their environment is obvious, as anyone who has been to Kiran Mazumdar's lovely home in Bangalore would attest. Swati Pirmal admits she was struck by Mazumdar's office. She says, "I visited her beautiful research centre, which is just stunning, all the work that she is doing and I really enjoyed her office, there were lots of beautiful paintings."

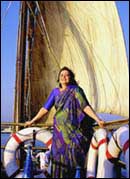

Swati Piramal's a free spirit who is into communing with nature. She says, "My big indulgence is my boat. Whenever I can, I take off with a few friends and we have this gourmet meal on the boat, with a glass of wine, with the sea and some great music for company. It’s so nice to get away from the city of Bombay because we have too much of traffic and buildings and when you are close to nature, you kind of respect everything."

Swati Piramal's a free spirit who is into communing with nature. She says, "My big indulgence is my boat. Whenever I can, I take off with a few friends and we have this gourmet meal on the boat, with a glass of wine, with the sea and some great music for company. It’s so nice to get away from the city of Bombay because we have too much of traffic and buildings and when you are close to nature, you kind of respect everything." These infrastructure problems do exist and that's what is keeping India back, on delivering on the brand-India promise. Mazumdar explains, "I don’t think the government is doing enough, because all that we want from the government is an enabling environment and infrastructure. Now in our business of biotechnology, there are lots of initiatives being taken and I think we have to address these with a sense of urgency. Somehow, I just feel that the government is not quite in sync with India Inc."

Piramal says, "I spoke to the Prime Minister only a few weeks ago and I said please do something to implement all the things that we have put together. If they can put that, India will really become a world power."

They have visions for a better country, and by the nature of their work, a better world. They also continue to be looked up to but whom do they idolise? Mazumdar says, "When I was setting up Biocon, I looked at certain people who have done things very differently. So I was very inspired by Jack Welch. In India, I was inspired by Professor Mashelkar because he was a big change-maker in science and technology. I was also inspired by Vaghul of ICICI and Narayan Murthy."

"The one woman who influenced me in terms of business, was Anita Roddick of Body Shop. I used to like her style of doing business because I have always looked at very unconventional people. I like unconventionality in people and I am very unconventional and when I set up the company, I certainly wanted it to be a very different kind of organisation and I insisted that every single person in the workplace call me by my first name, and I said everyone should call each other by their first name and it was quite an alien concept in those days."

Piramal's icon was the ultimate beacon of hope for the downtrodden, Mother Teresa. She recalls, "The one who really moved me, when I met her was Mother Teresa. She came to my hospital and she gave out packages to all the little kids who were paralyzed and she wrote that working for children is working for peace and she was so beautiful, that I can never forget her face. She was truly one of most beautiful women I have ever seen."

To order Kiran Mazumdar Shaw's coffee table book:

http://www.prakashbooks.com/details.php3?id=5965&c=Cookery,%20Food%20/%20Drinks

Written for www.moneycontrol.com