Shivinder Singh and Malvinder Singh have a lot in common, apart from names that sound alike. They went to the same college, St Stephens in Delhi and did their MBA from the same university and then branched out, but again in related areas. They don't seem to venture very far from each other. Malvinder Singh credits their parents for giving them the value system that the brothers have imbibed.

Shivinder Singh says the reason he's literally been following his brother's footsteps is that, both have such similar thought processes. They both like facts and figures, both want to get to their goals in a tearing hurry and ofcourse the common values, they grew up with.

Both had inherited the now internationally known, pharmaceutical firm, Ranbaxy, but Malvinder took up the reins as it is more his field of interest. While, Shivinder has branched out to providing healthcare services and has given North India, its very own, world-class hospital, Fortis Healthcare.

A vision became realityRanbaxy was a successful Indian pharmaceutical company, long before Malvinder Singh came on the scene. True, he's taken it into unchartered waters and given it a higher profile in the world press, but initially, did he have to battle perceptions that success had been handed to them easily?

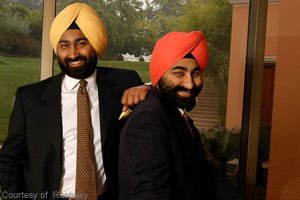

Malvinder Singh and Shivinder Singh

Malvinder Singh and Shivinder SinghMalvinder told CNBC-TV18, "At the time. When our father passed away, we had just been allocated a piece of land in Mohali, which is where our first hospital is today. Shivinder was still doing his MBA. we hadn't really made any significant investment in healthcare. It was also at that point in time, where we had a 500 sqft office in Delhi with only five people and both of us had a decision to make - whether we wanted to remain only in pharmaceuticals or we wanted to get into other areas of healthcare."

"I think both of us were very clear and very unanimous that this (the hospital) is something we wanted to do and we were going to do it. At that time, Fortis Healthcare was a 50:50 joint venture between the family and IL&FS. Dad brought them in at that time because he needed a partner as he wasn't well and both of us were young."

"But I went up to IL&FS and told them I want to drive it in a particular way and that I was willing to buy them out at a premium, and we did that. Today, it's a completely different story where we have a very clear gameplan on the healthcare side in North India."

Malvinder feels his father and Mr Brar made a very good combination, who were able to bring up Ranbaxy, to be the company it is today. He elaborates, "My father was a great visionary, who thought well beyond his time. I think what Ranbaxy is today, is primarily driven by the vision he and his team had."

"For him to really foresee and say, look I am not going to be limited to competing in India, which is only 1.5% of the global pharmaceutical market, but really want to go outside and compete where the markets are, which is in the US and in Europe. He did it, in a very phased manner and I think if you look at Mr Brar and my father, they are a very good combination as a team because he (Mr Brar) was a great executor."

Shivinder adds, "What Dr Singh gave us, was a great company as a legacy and a great vision. What we have today is, two other great companies, that were not there or virtually absent. Fortis Healthcare, which was a piece of land and SRL which was not there in our fold. Today, SRL is Asia's largest pathology network."

Burden of expectationsNow, with Ranbaxy aggressively moving into foreign markets and is sort of taking the competition to the enemy camp, the President and Executive Director of Ranbaxy, Malvinder Singh must be feeling the heat, with expectations being sky-high.

He says, "I think clearly from an expectations perspective, people would really want to look at you and see can Malvinder deliver, is he good or is he there because he is his father’s son. But that’s something I knew was going to happen, but it didn’t really bother me or make me very conscious of that fact. Right from the start, I have been fairly hardworking and I went about doing my job, just like anybody else in the organisation."

"I worked harder because I really enjoyed what I was doing. I had a dream and passion for what I was doing and wanted to really be a part of Ranbaxy's growth. But at the end of the day, I really started from the bottom as a management trainee and therefore, there was so much to do and so much to learn and Ranbaxy is a very exciting organisation."

He admits to having thought of a different career. He elaborates, "I actually started my career in the financial services industry with American Express and I worked with them as a management trainee in Delhi and Bombay. So when I started my career, it wasn’t in Ranbaxy and I did that very consciously because I wanted to work in a global organisation."

"I wanted to work outside Ranbaxy, so I could really learn and understand and be one among the many without really having anybody to see or feel that he is the boss’s son. Then there was the fact that I really wanted to and enjoyed working in the financial space."

"And if it hadn’t been for my father’s health, I would have probably worked in the investment banking arena internationally for sometime, but eventually come back because I had always seen my father, my grandfather, live and breathe Ranbaxy right through my childhood. It was something I wanted to carry forward."

Focus on healthcareShivinder Singh supports his brother's keenness for Ranbaxy's welfare and success, and says he's taken to it practically from the day he was born! On his part though, he knew pharma wasn't quite his cup of tea. He explains, "Maths and computers apart, pharma was just not something that clicked with me. But healthcare just happened, they are very connected but there are two fundamental differences."

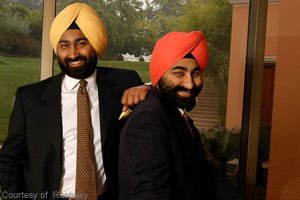

Shivinder Singh (l) with director of Fortis

Shivinder Singh (l) with director of Fortis

Healthcare, Harpal Singh"First, it is a service organisation and second, is that I didn’t like the idea of not dealing with the customer directly. One big disconnect that I had with pharma was you deal with the doctor, and doctor deals with the patient, you really don’t get to know what happens and healthcare gives both of them, on a platter."

ChallengesHaving inherited Ranbaxy, did Malvinder run into an entrenched system or people who didn't take to change eaily? Malvinder says, "Making people change when they have seen success by what they are doing is a challenge. But I think as an organisation we are mature, we have people who understand that we are living in a very different environment today and therefore what’s going to take us to the next level, is going to be different, from what got us here."

In contrast, Shivinder Singh got it easy. He explains, "I was sent to Mohali in Chandigarh as the head of the hospital and there was actually nothing there, there were no people! So I recruited every single staff, the culture, the attitude, the working style. So that way I had it much easier, I have had the chance to do it my way from scratch."

Shivinder, who is Joint Managing Director of Fortis Healthcare, is looking to make Fortis Healthcare an all-India presence sooner rather than later. That famed family restlessness is at work!

Malvinder explains, "I think we both push each other and he kind of challenges me, on many aspects, from a macro perspective and I challenge him. I think both of us are aggressive in our own ways and we want to ensure that we are growing fast, if not faster than what we can do. So, I think that really keeps both of us going."

Tycoon speakHeard Donald Trump say 'You are fired' on his show 'The Apprentice'?

Here is some choice soundbytes from the Singh brothers:

Do you have any weaknesses?

Malvinder Singh : Weakness, what is that?

Shivinder Singh : How do you spell that word?

Malvinder Singh : I don't know!

Famous last words these.

Written for www.moneycontrol.com

There is no escaping the media -and I'm a journalist saying this. Good for me, I'm a business (features) journalist or I would have wondered why I chose to be in this profession. But I do love to write - cliched as it may sound.

There is no escaping the media -and I'm a journalist saying this. Good for me, I'm a business (features) journalist or I would have wondered why I chose to be in this profession. But I do love to write - cliched as it may sound.